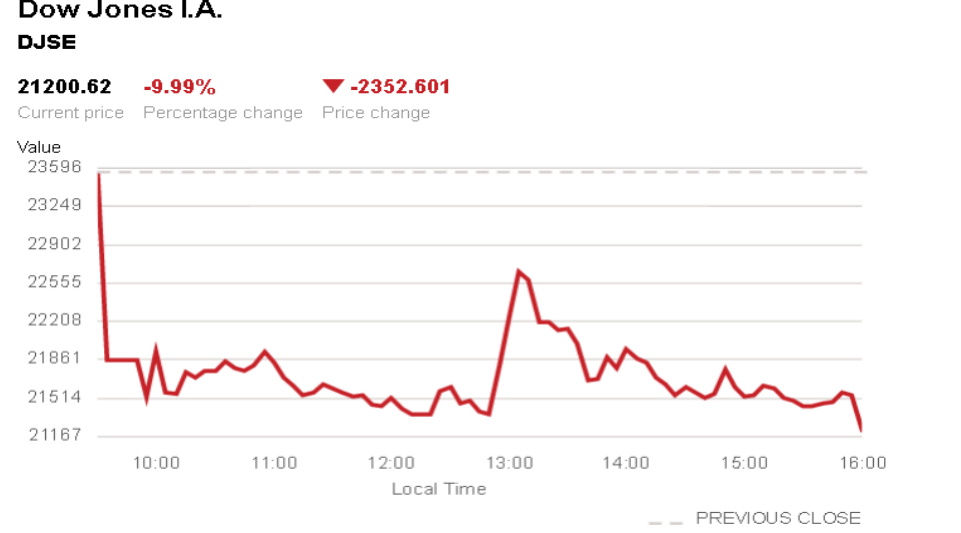

US stocks plummeted in their worst day since October 19, 1987, better known as “Black Monday.”

Back to zero: Fed could make dramatic cuts very soon to stop the panic

Wall Street is betting the Federal Reserve will respond to the coronavirus panic by returning to 2008-style interest rates.

Barclays predicted Thursday the Fed will slash interest rates by a full percentage point to zero at next week’s meeting — if not earlier, in an emergency action.

“Given the ongoing weakness in investor sentiment and deterioration in market functioning, we now believe a more aggressive response is warranted,” Barclays economists wrote in a note to clients.

It was almost unthinkable just a few weeks ago that the Fed would need to go back to zero in 2020. Now, the market is pricing in a return to zero, not later this year but imminently.

After the Dow suffered its worst day since 1987 on Thursday, the market priced in a 95% chance the Fed cuts rates to a range of zero to 0.25%, according to the CME FedWatch Tool. That compares with no chance of that just a week ago: a truly stunning reversal.

And the Fed is taking other dramatic steps to calm panicky markets. It promised to pump $1.5 trillion into financial markets Thursday and effectively relaunched the 2008-era bond buying program known as quantitative easing, or QE.

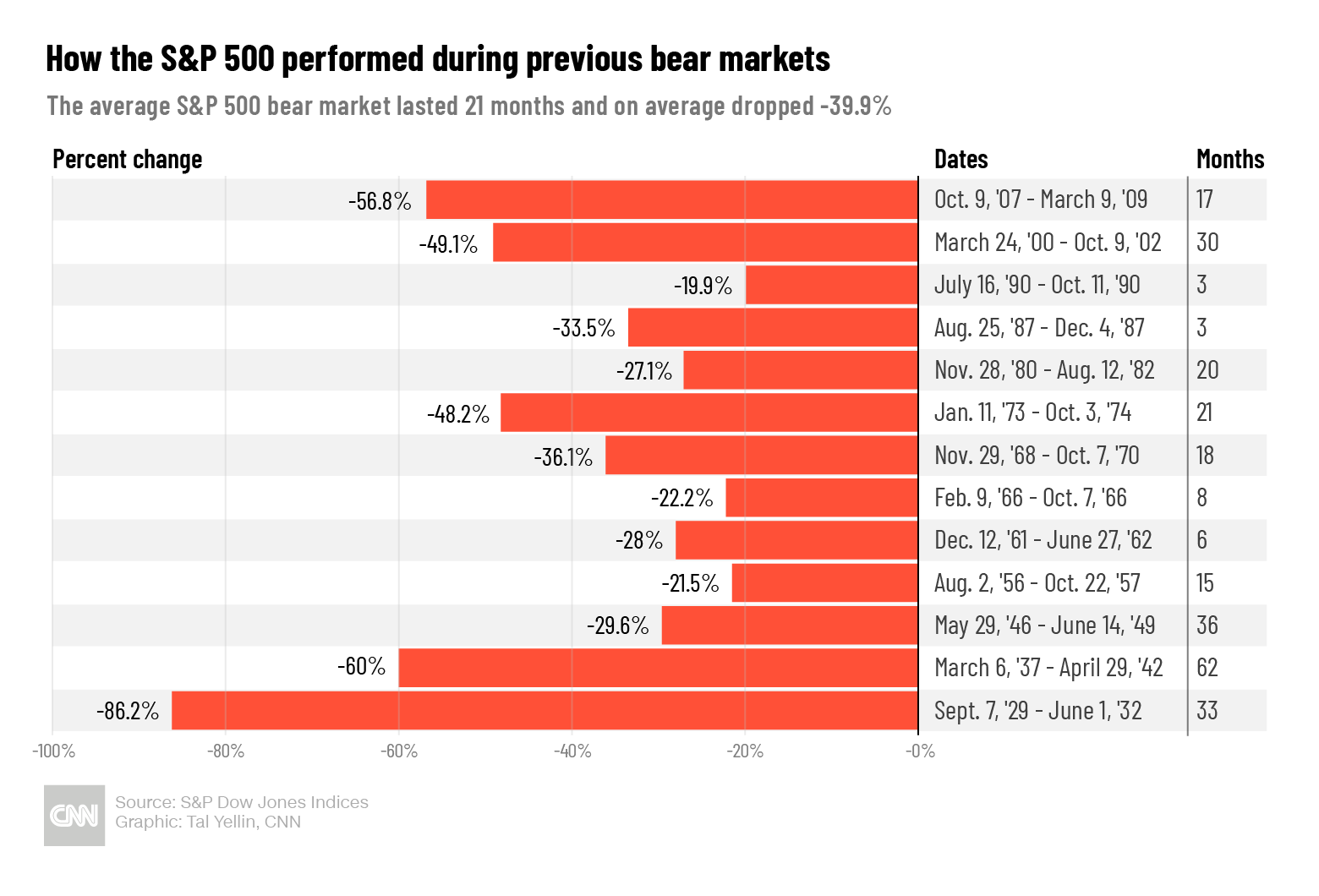

How long will this bear market last?

It’s hard to know exactly how long the new bear market will last. The average bear market has lasted 21 months, with the shortest in 1990 and the longest beginning in 1937.

Here’s how long previous bear markets have lasted:

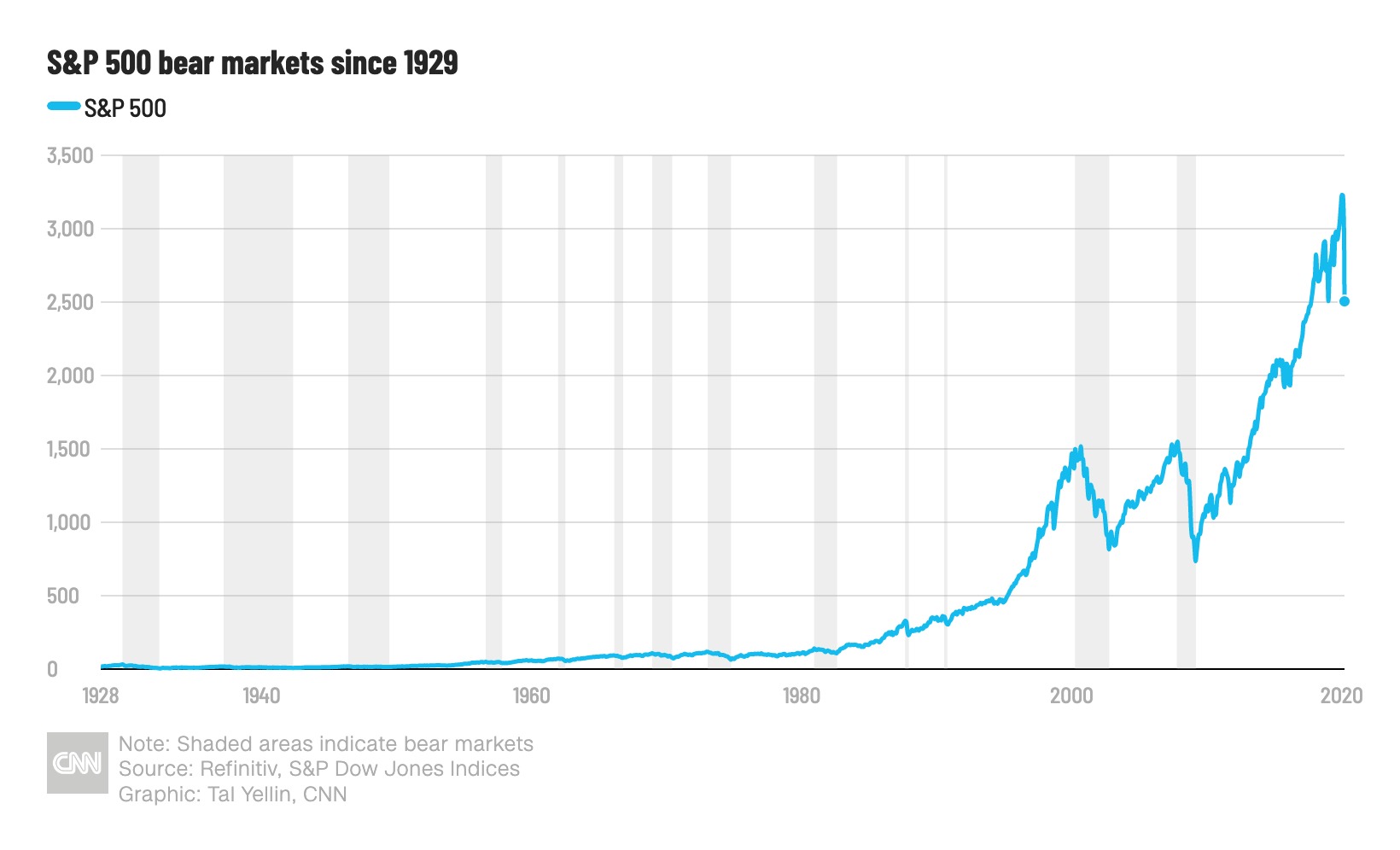

The longest bull market in American history is over after 11 years

Less than a month after hitting a high of 3,386 on February 19, the S&P 500 sold off sharply, falling more than 25% as novel coronavirus spreads around the world. An oil price war between Saudi Arabia and Russia also emerged, threatening US shale producers and exacerbating selling over the past week.

The S&P 500 closed below 2,708.92, officially marking the end of the bull rally and the start of the new bear market. Here are the previous 13 bear markets since 1929.

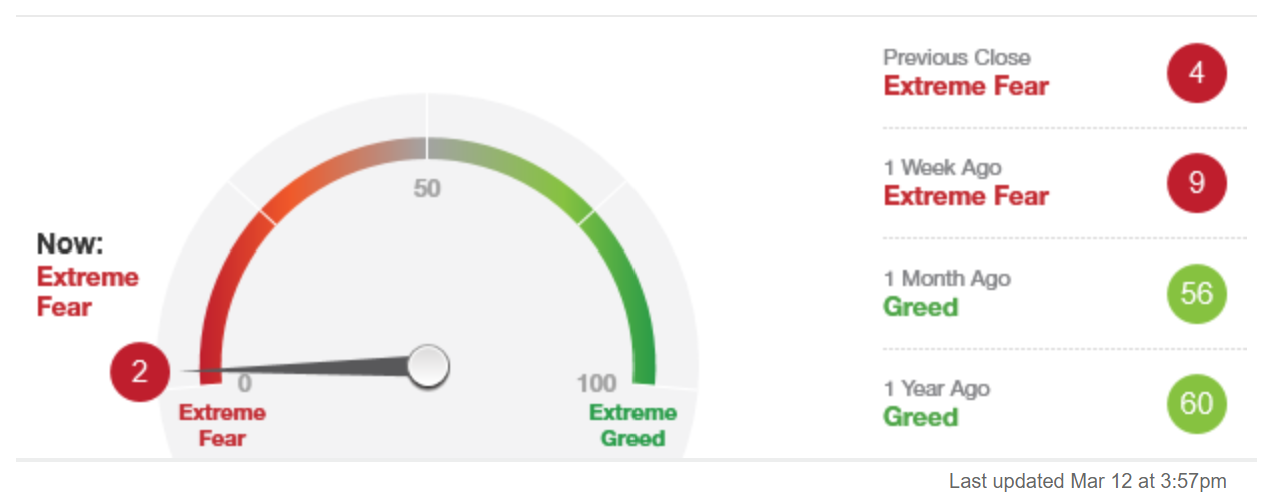

Extreme fear has consumed the stock market

CNN Business’ Fear and Greed Index sits at “2” out of 100. That’s just about as fearful as the market can get.

The VIX volatility index soared 39.5% Thursday to its highest level since October 2008 during one of the scariest moments of the global financial crisis.

Wall Street’s 11-year bull market comes to a screeching halt: Stocks plummet

US stocks recorded their worst day since 1987 Thursday as worries about the coronavirus pandemic mounted.

Wall Street officially fell into a bear market with the S&P 500 dropping more than 20% from its February 19 peak. The Dow, a smaller index than the S&P, fell into a bear market Wednesday.

That officially ended the 11-year bull market — the longest in history — which started in March 2009.

On Thursday, the S&P 500 closed down 9.5%. It was its worst day since October 19, 1987, also known as “Black Monday”.

The index dropped 7% in the first minutes of trading, which triggered a circuit breaker and led the New York Stocks Exchange to suspend trading for 15 minutes.

The Dow was down 2,353 points, nearly 10% lower, in its biggest one-day percentage drop since “Black Monday.” The index is at its lowest level since the summer of 2017.

The Nasdaq Composite closed down 9.4%. It is now also in a bear market.

Wall Street is on track for a bear market

With only minutes left in the trading day, Wall Street is on course to close in a bear market.

Only the Dow slipped into a bear market Wednesday, but now the S&P 500 — the broadest measure of the US stock market — is squarely in bear territory as well. A bear market is defined at 20% below the most recent peak, which for the major US indexes was in February. The pace at which the market has gone from record highs to a bear is remarkably fast.

The S&P 500 was down 7.7%, while the Dow was 8.3%, or 1,945 points, lower with just minutes remaining in the session.

![]()